4QFY2018 Result Update | Cable

May 21, 2018

KEI Industries

BUY

CMP

`433

Performance Update

Target Price

`508

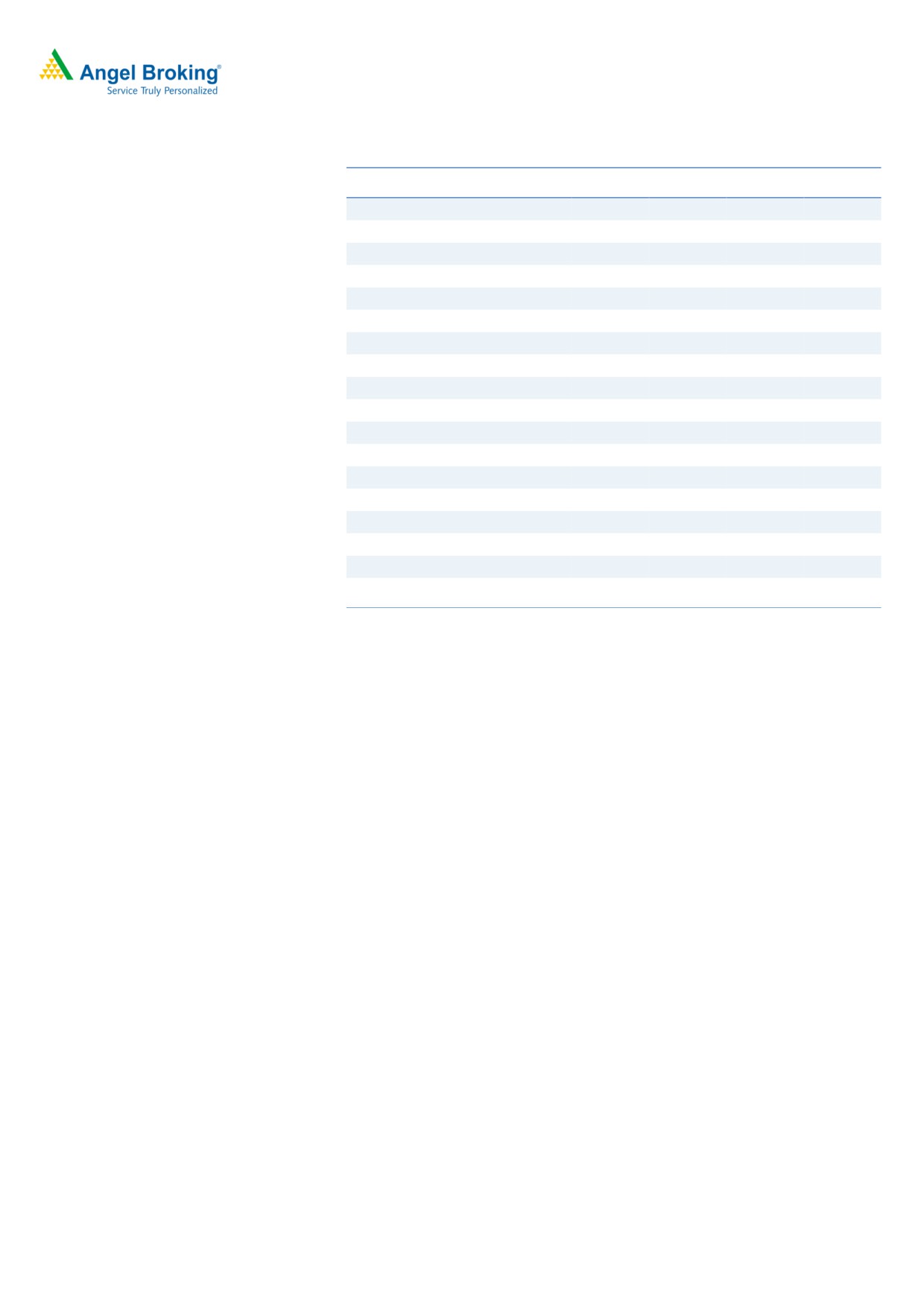

Y/E March (` cr)

4QFY18

4QFY17

% yoy

3QFY18

% qoq

Investment Period

12 months

Net sales

1,030

739

39

889

16

EBITDA

101

73

39

84

20

Stock Info

Sector

Cable

EBITDA margin (%)

9.8

9.9

(0.05bps)

9.5

0.3

Market Cap (Rs cr)

3,393

Adjusted PAT

50

35

40

39

27

Net Debt

750

Beta

0.6

Source: Company, Angel Research

52 Week High / Low

471/198

Avg. Daily Volume

16,814

For 4QFY2018, KEI Industries (KEI) posted good set of results, exceeding our

Face Value (Rs)

2

expectations on both, top-line as well as bottom-line fronts. Revenues grew by

BSE Sensex

33,812

~39% yoy (above our estimate), however, the company reported flat operating

Nifty

10,442

Reuters Code

KEIN.BO

margins. On the bottom-line front, KEI reported growth of ~40% yoy to `50cr on

Bloomberg Code

KEII.IN

the back of strong top-line growth and lower interest cost.

Top-line driven by strong volume growth: The Company’s top-line grew by ~39%

Shareholding Pattern (%)

Promoters

46.3

yoy to `1,030cr on the back of strong growth in cable prime segment i.e. Cables

MF / Banks / Indian Fls

12.4

and Turnkey Projects. Cable segment grew by ~24.3% yoy during the quarter,

FII / NRIs / OCBs

6.4

whereas Turnkey Projects reported a growth of ~42% yoy. Currently, the company

Indian Public / Others

34.9

has order book of `2,570cr (out which EPC is around `1,425cr and balance from

cables, substation & EHV)

Abs. (%)

3m 1yr 3yr

Sensex

7.4

27.1

22.9

Profitability driven by strong revenue growth and lower interest: On the operating

KEI

16.3

100.5

553.8

front, the company’s margin remained flat on yoy basis at 9.8%. However, KEI

reported ~40% yoy rise in its net profit to `50cr on the back of strong revenue

growth and lower interest cost.

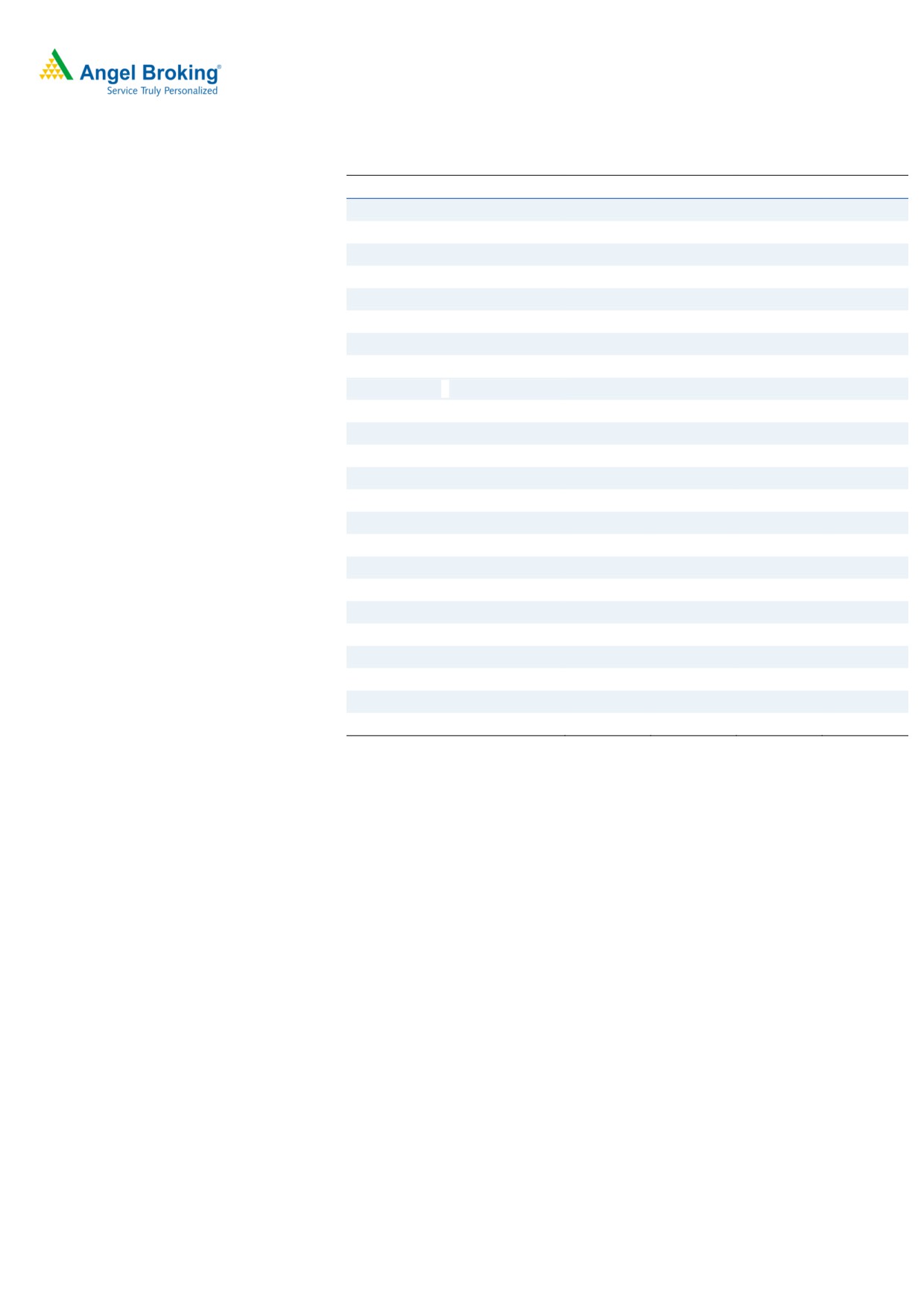

Outlook and Valuation: We expect KEI to report net revenue CAGR of ~16% to

~`4,646cr over FY2018-19E mainly due to (a) higher order book execution in

EPC segment; (b) growth in EHV business; (c) higher B2C sales; and (d) higher

exports. On the bottom-line front, we expect a CAGR of ~19% to `207cr over the

same period on the back strong revenue and lower interest costs. At the CMP of

`433, the stock trades at 16.2x its FY2020E EPS of `26.8. Thus, we maintain our

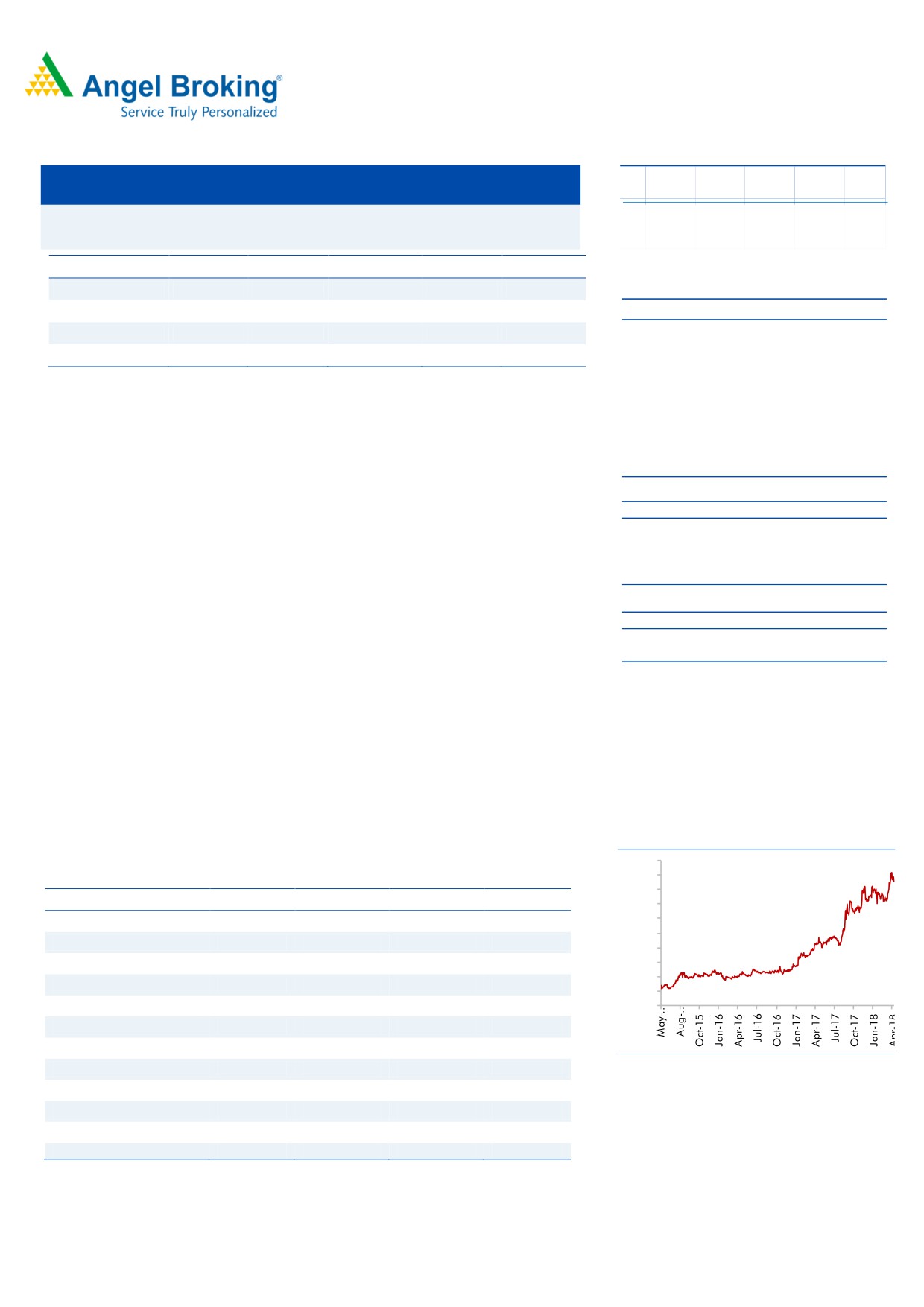

Historical share price chart

Buy rating with the Target Price of `508.

500

450

Key Financials

400

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

350

300

Net sales

2,628

3,466

4,049

4,646

250

% chg

13.0

31.8

16.8

14.7

200

Adj. Net profit

94

145

174

207

150

100

% chg

50.6

54.6

19.9

19.1

50

EBITDA margin (%)

10.2

9.8

10.0

10.0

-

EPS (`)

12.1

18.7

22.5

26.8

P/E (x)

35.7

23.1

19.3

16.2

P/BV (x)

7.1

5.5

4.4

3.5

Source: Company, Angel Research

RoE (%)

19.8

23.8

22.6

21.6

Amarjeet S Maurya

RoCE (%)

20.3

22.6

24.4

24.9

022-40003600 Ext: 6831

EV/Sales (x)

1.5

1.2

1.0

0.8

EV/EBITDA (x)

14.9

11.8

9.8

8.5

Source: Company, Angel Research Note

Please refer to important disclosures at the end of this report

1

KEI Industries| 4QFY2018 Result Update

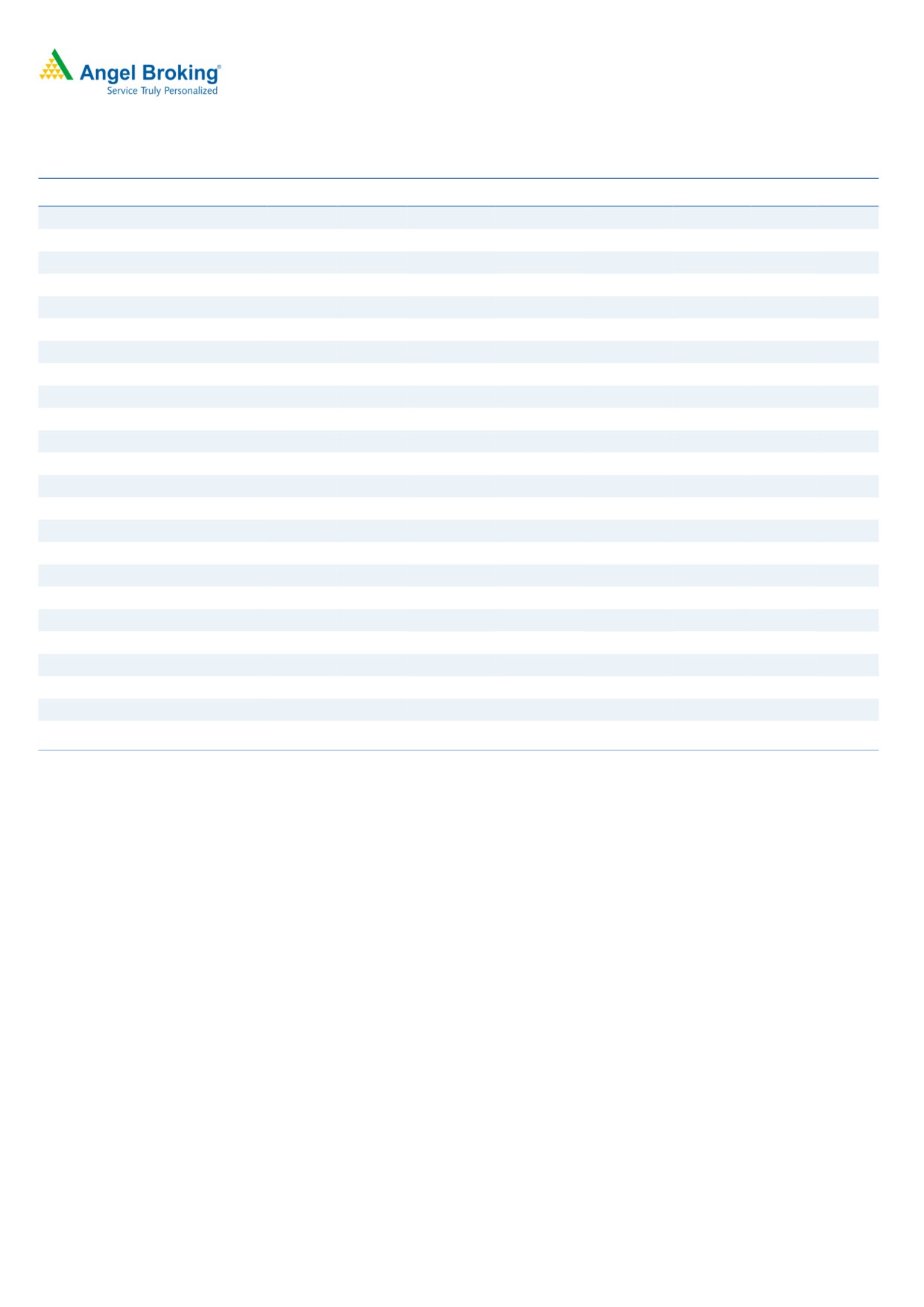

Exhibit 1: 4QFY2018 Performance

Y/E March (` cr)

4QFY18

4QFY17

% yoy

3QFY18

% qoq

FY2018

FY2017

% chg

Net Sales

1,030

739

39.4

889

16.0

3,466

2,628

31.8

Consumption of RM

715.7

539

32.8

621

15.2

2,411

1,828

31.9

(% of Sales)

69.5

72.9

69.9

69.6

69.5

Staff Costs

41

32

28.7

37

10.7

147

112

31.4

(% of Sales)

4.0

4.3

4.2

4.2

4.3

Other Expenses

173

95

81.1

146

18.2

568

420

35.2

(% of Sales)

16.8

12.9

16.5

16.4

16.0

Total Expenditure

929

666

39.5

804

15.5

3,126

2,360

32.5

Operating Profit

101

73

38.7

84

19.9

339

269

26.2

OPM

9.8

9.9

9.5

9.8

10.2

Interest

28.8

30.2

(4.4)

25.1

14.6

112

124

(10.1)

Depreciation

8.0

7.8

3.0

8.2

(2.8)

32

28

13.5

Other Income

(1)

7

7

9

10

PBT (excl. Ext Items)

64

42

52.1

58

9.2

204

126

62.2

Ext (Income)/Expense

PBT (incl. Ext Items)

64

42

52.1

58

9.2

204

126

62.2

(% of Sales)

6.2

5.7

6.6

5.9

4.8

Provision for Taxation

14

7

19

60

32

(% of PBT)

22.1

15.6

33.0

29.2

25.7

Reported PAT

50

35

40.4

39

27.0

145

94

54.6

PATM

4.8

4.8

4.4

4.2

3.6

Minority Interest After NP

Extra-ordinary Items

Reported PAT

50

35

40.4

39.02

27.0

144.8

93.6

54.6

Source: Company, Angel Research

May 21, 2018

2

KEI Industries| 4QFY2018 Result Update

Outlook and Valuation

We expect KEI to report net revenue CAGR of ~16% to ~`4,646cr over FY2018-

19E mainly due to (a) higher order book execution in EPC segment; (b) growth in

EHV business; (c) higher B2C sales; and (d) higher exports. On the bottom-line

front, we expect a CAGR of ~19% to `207cr over the same period on the back

strong revenue and lower interest costs. At the CMP of `433, the stock trades at

16.2x its FY2020E EPS of `26.8. Thus, we maintain our Buy rating with the Target

Price of `508.

Downside risks to our estimates

KEI’s EPC segment contributes ~14% in the total revenue. This segment

primarily depends upon government spending and any delay in investment

by the government may lead to reduction in order book and would impact its

revenue.

Any unfavorable change in the prices of commodities, forex and interest

rates, and delay in project execution can hurt its profitability.

Company Background

KEI Industries Limited (KEI) is a cable manufacturing company, engaged in

manufacture and supply of power and other industrial cables. The company is also

engaged in Engineering, Procurement and Construction (EPC) business. It operates

through Cables and Turnkey Projects segments and has its manufacturing facilities

at Bhiwadi & Chopanki in Rajastahn and Silvassa in Dadra and Nagar Haveli.

The cables segment comprises of a whole range of cables such as Extra High

Voltage (EHV), High tension (HT) and low tension (LT) power cables, control and

instrumentation cables, winding wires, flexible wires, and house and stainless steel

wires. Their products are supplied to various sectors like oil refineries, railways,

automobiles, cement, steel, fertilizers, textile and real estate sectors.

May 21, 2018

3

KEI Industries| 4QFY2018 Result Update

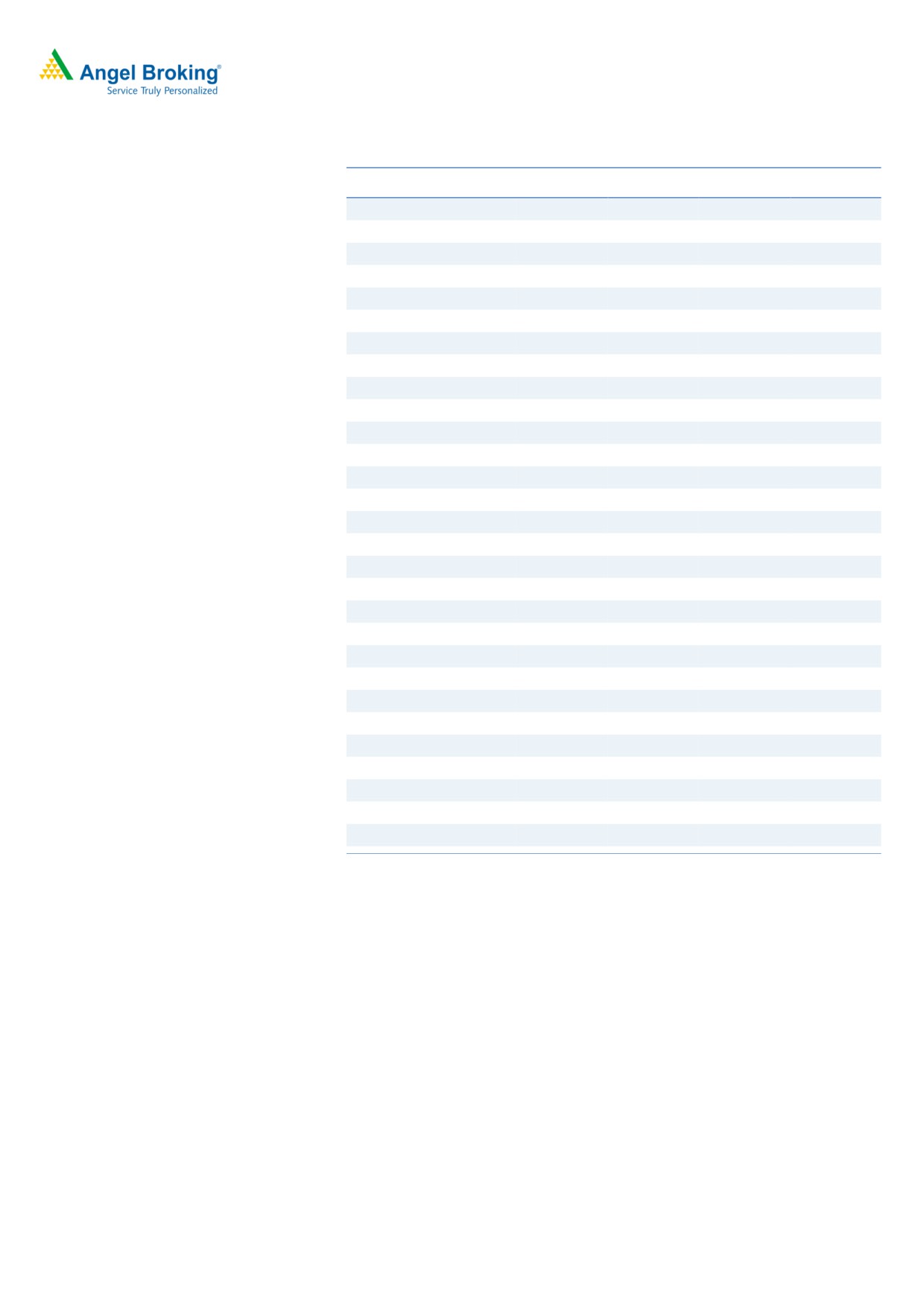

Profit & Loss Statement

Y/E March (`cr)

FY2017

FY2018

FY2019E

FY2020E

Total operating income

2,628

3,466

4,049

4,646

% chg

13.0

31.8

16.8

14.7

Total Expenditure

2,360

3,126

3,644

4,181

Raw Material

1,828

2,411

2,859

3,280

Personnel

112

147

170

195

Others Expenses

420

568

615

706

EBITDA

269

339

405

465

% chg

11.0

26.2

19.4

14.7

(% of Net Sales)

10.2

9.8

10.0

10.0

Depreciation& Amortisation

28

32

35

40

EBIT

240

307

370

425

% chg

10.8

27.7

20.4

15.0

(% of Net Sales)

9.1

8.9

9.1

9.1

Interest & other Charges

124

112

121

127

Other Income

10

9

10

10

(% of PBT)

8.0

4.5

3.9

3.2

Share in profit of Associates

-

-

-

-

Recurring PBT

126

204

259

309

% chg

32.2

62.2

26.7

19.1

Tax

32

60

86

102

(% of PBT)

25.7

29.2

33.0

33.0

PAT (reported)

94

145

174

207

Extraordinary Items

-

-

-

-

ADJ. PAT

94

145

174

207

% chg

50.6

54.6

19.9

19.1

(% of Net Sales)

3.6

4.2

4.3

4.4

Basic EPS (Rs)

12.1

18.7

22.5

26.8

Fully Diluted EPS (`)

12.1

18.7

22.5

26.8

% chg

50.6

54.6

19.9

19.1

May 21, 2018

4

KEI Industries| 4QFY2018 Result Update

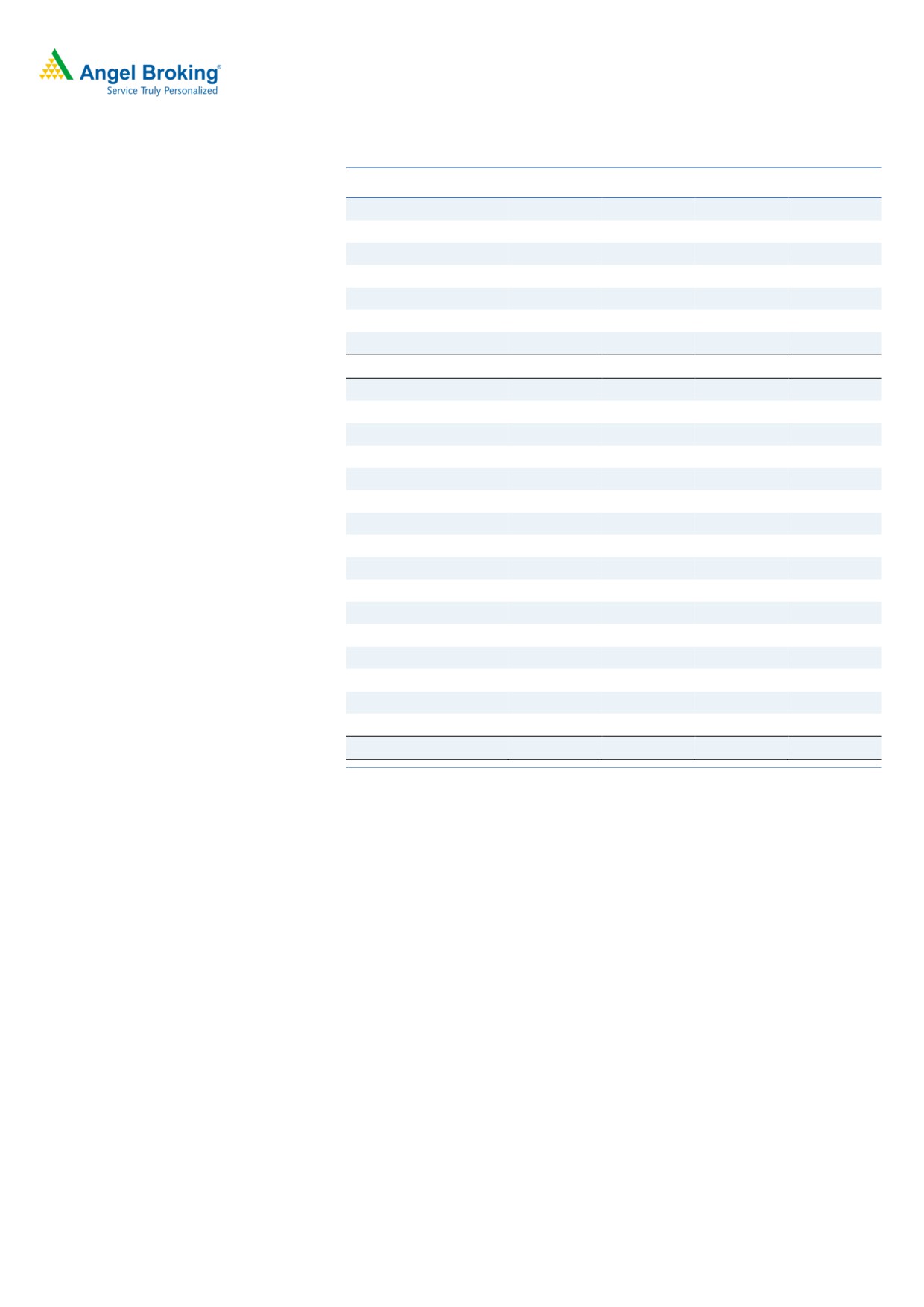

Balance Sheet

Y/E March (`cr)

FY2017

FY2018

FY2019E

FY2020E

SOURCES OF FUNDS

Equity Share Capital

16

16

16

16

Reserves& Surplus

458

593

752

942

Shareholders Funds

473

608

768

958

Minority Interest

-

-

-

-

Total Loans

713

750

750

750

Deferred Tax Liability

46

46

46

46

Total Liabilities

1,233

1,404

1,564

1,755

APPLICATION OF FUNDS

Gross Block

604

624

654

685

Less: Acc. Depreciation

199

231

266

306

Net Block

405

393

388

380

Capital Work-in-Progress

3

3

3

3

Investments

3

3

3

4

Current Assets

1,399

1,830

2,158

2,514

Inventories

499

665

777

891

Sundry Debtors

739

883

1,032

1,184

Cash

37

76

107

160

Loans & Advances

119

173

202

232

Other Assets

5

34

40

46

Current liabilities

582

829

992

1,149

Net Current Assets

818

1,001

1,166

1,365

Deferred Tax Asset

3

3

3

3

Mis. Exp. not written off

-

-

-

-

Total Assets

1,233

1,404

1,564

1,755

May 21, 2018

5

KEI Industries| 4QFY2018 Result Update

Consolidated Cashflow Statement

Y/E March (`cr)

FY2017

FY2018

FY2019E FY2020E

Profit before tax

134

204

259

309

Depreciation

34

32

35

40

Change in Working Capital

(259)

(145)

(134)

(145)

Interest / Dividend (Net)

123

112

121

127

Direct taxes paid

(30)

(60)

(86)

(102)

Others

3

0

0

0

Cash Flow from Operations

4

144

196

227

(Inc.)/ Dec. in Fixed Assets

1

(20)

(30)

(31)

(Inc.)/ Dec. in Investments

(62)

0

0

0

Cash Flow from Investing

(62)

(20)

(30)

(31)

Issue of Equity

0

0

0

0

Inc./(Dec.) in loans

251

37

0

0

Dividend Paid (Incl. Tax)

(4)

(10)

(14)

(17)

Interest / Dividend (Net)

(158)

(112)

(121)

(127)

Cash Flow from Financing

89

(85)

(135)

(143)

Inc./(Dec.) in Cash

31

39

31

53

Opening Cash balances

6

37

76

107

Closing Cash balances

37

76

107

160

May 21, 2018

6

KEI Industries| 4QFY2018 Result Update

Key Ratios

Y/E March

FY2017

FY2018

FY2019E

FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

35.7

23.1

19.3

16.2

P/CEPS

27.4

18.9

16.0

13.6

P/BV

7.1

5.5

4.4

3.5

Dividend yield (%)

0.2

0.3

0.4

0.5

EV/Sales

1.5

1.2

1.0

0.8

EV/EBITDA

14.9

11.8

9.8

8.5

EV / Total Assets

3.3

2.9

2.5

2.2

Per Share Data (`)

EPS (Basic)

12.1

18.7

22.5

26.8

EPS (fully diluted)

12.1

18.7

22.5

26.8

Cash EPS

15.8

22.9

27.0

31.9

DPS

0.7

1.3

1.8

2.1

Book Value

61.3

78.7

99.4

124.0

Returns (%)

ROCE

20.3

22.6

24.4

24.9

Angel ROIC (Pre-tax)

21.0

24.0

26.3

27.5

ROE

19.8

23.8

22.6

21.6

Turnover ratios (x)

Asset Turnover (Gross Block)

4.3

5.6

6.2

6.8

Inventory / Sales (days)

69

70

70

70

Receivables (days)

103

93

93

93

Payables (days)

42

40

41

42

Working capital cycle (ex-cash) (days)

130

123

122

121

May 21, 2018

7

KEI Industries| 4QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking

or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or

in the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

KEI Industries

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

May 21, 2018

8